The rapid implementation of VAT filing software in Oman allows companies to obtain efficient and reliable VAT reporting software. As companies seek to comply with tax regulations while maintaining operational efficiency, choosing the right software will be important. In this blog, we will explore the advantages of VAT filing software in Oman and why it is the first choice for businesses. GCC) was launched in Oman as part of an agreement to diversify the economy and reduce dependence on oil revenues. For businesses, this means complying with new tax rules and ensuring accurate VAT calculations and declarations.VAT filing software in Oman has many benefits that make it important for business:

Accuracy and compliance: VAT filing software in Oman reduces the risk of errors by automating complex calculations and complies with Oman's VAT regulations. This helps businesses avoid fines and audits. VAT filing software in Oman streamlines the process, allowing businesses to focus on core activities while also ensuring timely and accurate reporting. Explain its VAT and financial situation. This can improve decision making and financial planning. Data Management: Advanced VAT reporting software provides advanced security features to protect sensitive financial data, ensure confidentiality and comply with data protection laws. Having many advantages, tax documents have become the first choice for doing business in Oman for many reasons:

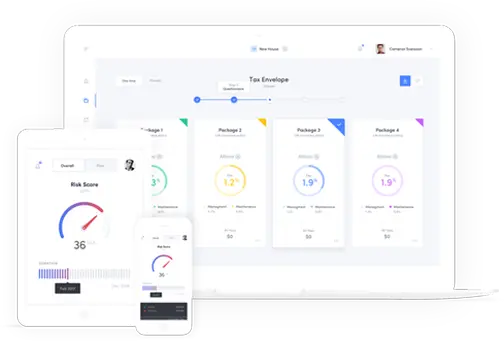

Regulatory Compliance: Oman's VAT laws require accurate records to be kept and taxes to be collected correctly. VAT filing software in Oman is designed to meet these specific requirements and ensure business compliance. An intuitive interface and easy-to-follow steps simplify the filing process.VAT filing software in Oman reduces administrative costs and reduces the risk of costly errors. Whether you're a small business or a large company, VAT filing software in Oman can scale to meet your changing needs, ensuring compatibility and efficiency. Support includes training, customer service and updates to keep the software up to date with changes in VAT regulations. The specific needs of the business. This flexibility allows the software to be customized to the specific operation. Key features for ease of use How to use:

Automatic VAT calculation: The software should automatically calculate VAT according to the new rules, reducing the number of entries and error experience Reports and dashboards provide information on VAT liability and financial performance. Strong security measures protect sensitive data from unauthorized access and financial information leakage.

Continuous updates: Regular updates to comply with new VAT regulations and technological developments. Be honest, efficient and fulfill your obligations. VAT filing software in Oman will help businesses save time, reduce costs and obtain forgiveness by automating complex calculations and streamlining the application process. Efficiency, scalability and quality of support. Considering these factors, businesses in Oman can confidently choose VAT filing software as the first choice to manage VAT compliance and ensure efficiency and financial security.