20 April, 2023

ERP stands for Enterprise Resource Planning, which is a type of software that integrates various business processes and functions into a single system. It is a comprehensive suite of tools that includes modules for online accounting software, HR management software, inventory management software, and more.

ERP accounting software in Qatar options available that can meet the needs of businesses looking for simple accounting software, online HR management software, online stock management software, and other related solutions.

ERP accounting software solution can help businesses in Qatar to manage their financials, track expenses, automate accounting processes, and generate financial reports. It can also provide features for managing employee data, payroll processing, benefits administration, and other HR-related functions. Additionally, it can help businesses to manage their inventory levels, track stock movement, and generate reports on inventory usage. ERP accounting software in Qatar system can help businesses in Qatar streamline their operations, reduce manual errors, and improve their overall efficiency. By incorporating various business functions into a single system, businesses can achieve better visibility into their operations, make more informed decisions, and ultimately drive better business outcomes.

ERP accounting software solutions offer a range of features that can help businesses in Qatar to manage their financials effectively. For example, these systems typically include tools for managing accounts payable and receivable, general ledger accounting, and financial reporting. They may also include features for managing budgets, generating invoices, and tracking expenses.

Online HR management software, an ERP accounting software solution can provide businesses in Qatar with tools for managing employee data, including personal information, employment history, and benefits information. It can also offer features for managing time and attendance, tracking performance, and generating reports on HR metrics. Additionally, it can provide employees with self-service portals where they can view their benefits information, submit time off requests, and access other HR-related resources.

Online stock management software is another area where an ERP accounting software solution can be beneficial. These systems can help businesses in Qatar to manage their inventory levels, track stock movement, and optimize their purchasing processes. They can also provide features for generating reports on inventory usage, identifying slow-moving items, and forecasting demand.

ERP accounting software solution can provide businesses in Qatar with a range of benefits. By automating and integrating various business processes, these systems can help businesses to save time, reduce costs, and improve their overall efficiency. They can also provide businesses with greater visibility into their operations, enabling them to make more informed decisions and drive better business outcomes.

20 April, 2023

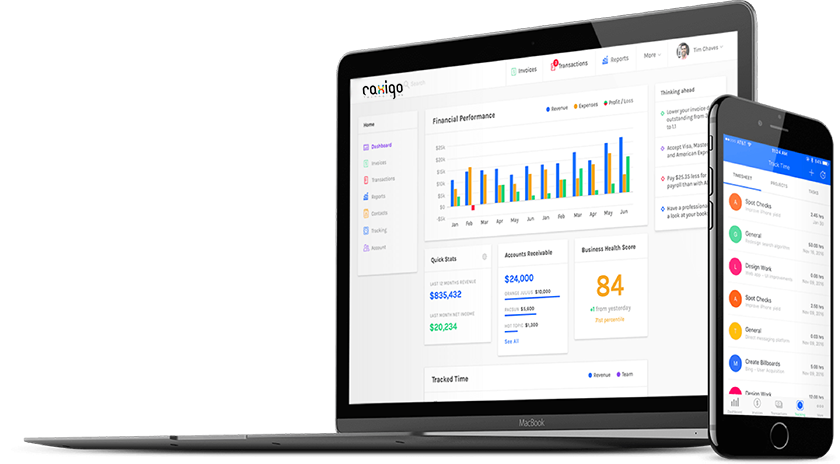

Online accounting software in Qatar is a digital tool that allows businesses in Qatar to manage their financial transactions, such as invoicing, bookkeeping, and reporting, through the internet. With online accounting software, business owners can access real-time financial data from anywhere, at any time, without having to install any software on their local computers. This makes it easier for businesses to stay on top of their finances and make informed decisions.

Online stock management in Qatar refers to the use of digital tools to manage a company's inventory or stock levels. This includes tracking stock levels, managing orders and deliveries, and optimizing stock levels to ensure that the business has enough inventory to meet demand while minimizing waste. Online stock management software in Qatar makes it easier for businesses to keep track of their stock levels and ensure that they always have the right products on hand.

Stock management software in Qatar is a broader term that encompasses both online stock management and stock management software tools. This type of online accounting software can be installed on a local computer or server and is used to manage inventory, track orders, and manage suppliers. Stock management software in Qatar can be customized to meet the specific needs of a business and can integrate with other business systems to provide a complete view of the company's operations.

Billing software in Qatar is a tool that businesses can use to create and send invoices to their customers. Billing software in Qatar can automate the invoicing process, reducing the time and effort required to create and send invoices manually. With billing software, businesses in Qatar can also track payments, manage overdue invoices, and generate reports to track their financial performance.

Online accounting software, online stock management, stock management software, and billing software - all refer to digital tools that businesses in Qatar can use to manage their finances, inventory, and billing processes more efficiently and effectively.

19 April, 2023

Online accounting software in UAE is a type of computer program that helps businesses manage their financial transactions and keep track of their financial records. It is an essential tool for businesses of all sizes, including those in the UAE, as it allows them to efficiently manage their finances and make informed decisions.

When it comes to choosing online accounting software in the UAE, businesses should look for a system that is easy to use, reliable, and secure. Additionally, they may also want to consider whether the software integrates with other systems, such as online HR management software and online stock management software.

Simple accounting software in the UAE, they may want to consider a program that includes features like invoicing, expense tracking, and financial reporting. They may also want to look for a system that integrates with online HR management software in the UAE, which can help streamline processes like payroll and employee record-keeping. Additionally, integrating with online stock management software in the UAE can help businesses keep track of inventory levels and monitor stock movements in real-time.Online accounting software in UAE that is tailored to the specific needs of a business in the UAE can help them manage their finances more efficiently, reduce errors and inaccuracies, and make better-informed decisions.

Simple accounting software in UAE: Simple accounting software UAE is a basic accounting software that is designed for small to medium-sized businesses. It typically includes features such as invoicing, expense tracking, financial reporting, and basic inventory management. In the UAE, there are several options for simple accounting software, including both cloud accounting software and on-premises solutions.

Online HR management software in UAE: Online HR management software is a cloud accounting software solution that helps businesses manage their human resources functions, including employee record-keeping, payroll management, benefits administration, and performance management. In the UAE, there are several options for online HR management software.

Online stock management software in UAE: Online stock management software is a cloud accounting software solution that helps businesses manage their inventory levels and monitor stock movements in real-time. It typically includes features such as inventory tracking, order management, and reporting. In the UAE, there are several options for online stock management software.

Integrating these software solutions together can help businesses streamline their operations and make better-informed decisions by having real-time access to data from various functions of the business.

Cloud accounting software in UAE: Cloud accounting software is a type of software that is hosted on remote servers and accessed via the internet. This type of software is becoming increasingly popular in the UAE due to its ease of use, affordability, and flexibility. Cloud accounting software typically includes features such as invoicing, expense tracking, financial reporting, and automatic bank feeds. Some popular cloud accounting software options in the UAE include Proffinonline.

VAT-compliant accounting software in UAE: Since the implementation of Value Added Tax (VAT) in the UAE, businesses are required to maintain accurate VAT records and comply with the regulations set by the Federal Tax Authority (FTA). VAT-compliant accounting software can help businesses easily manage their VAT obligations by automating VAT calculations, generating VAT reports, and facilitating VAT returns. Some popular VAT-compliant accounting software in UAE options in the UAE include Proffinonline.

ERP accounting software in UAE: Enterprise Resource Planning (ERP) accounting software in UAE is a type of software that integrates various business functions, including accounting, online HR management software, inventory management, and more, into a single system. This type of software is suitable for large businesses and can help them manage their operations more efficiently and effectively. Some popular ERP accounting software in UAE options in the UAE include Proffinonline.

UAE can benefit greatly from using accounting software in UAE that is tailored to their specific needs and requirements. By automating financial processes and having real-time access to financial data, businesses can make more informed decisions and improve their overall financial health.

19 April, 2023

ERP (Enterprise Resource Planning) accounting software is a type of software that integrates all aspects of business operations, including accounting, financial management, inventory management, customer relationship management, and human resources management. This type of software is designed to help businesses streamline their processes and improve their efficiency.

In the UAE, there are several options for online accounting software that offer ERP accounting software in UAE functionality. Some of the best accounting software options in the UAE include Proffinonline.

Cloud accounting software in UAE is becoming increasingly popular in the UAE due to its many benefits, including the ability to access data from anywhere, automatic updates, and data security. Many of the top ERP accounting software in UAE are cloud accounting software, including Proffinonline.

When choosing an ERP accounting software in the UAE, it's important to consider factors such as the size of your business, your specific accounting needs, and your budget. Additionally, it's essential to choose a online accounting software in UAE that is compliant with local regulations and can handle local tax requirements. ERP accounting software in UAE is a powerful tool that can help businesses in the UAE manage their finances and operations more effectively, and there are several excellent options available in the market, including cloud accounting software solutions.

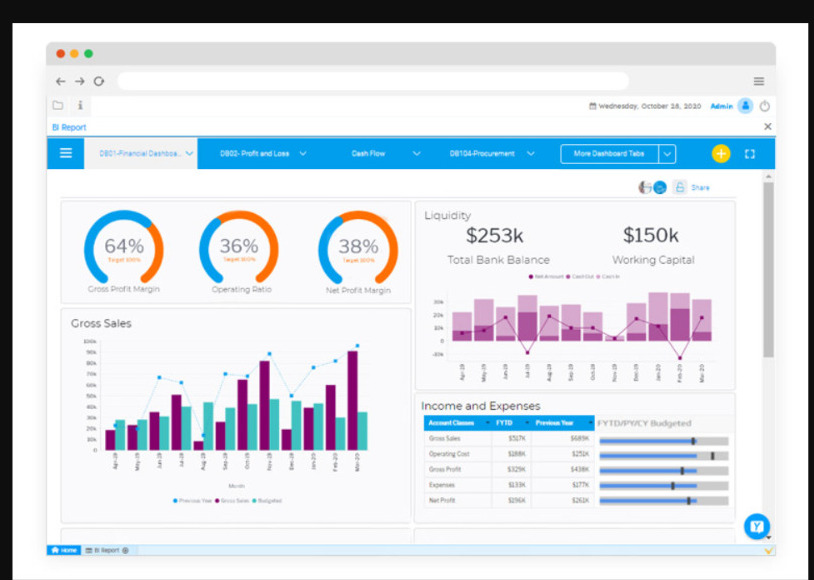

ERP accounting software in UAE provides a comprehensive view of a company's financial situation, allowing for better decision-making, forecasting, and budgeting. It can automate many accounting tasks, such as invoicing, billing, and reconciling accounts, freeing up time for more strategic work.

Best accounting software functions, ERP accounting software typically includes modules for other business operations such as procurement, inventory management, project management, and customer relationship management (CRM). This integration allows for more efficient workflows and better communication between different departments in the organization.

ERP accounting software can also help businesses in the UAE comply with local tax laws and regulations, such as the implementation of the Value Added Tax (VAT) in 2018. Some software even has built-in features to calculate and file VAT returns.

Cloud-based ERP accounting software is becoming more prevalent in the UAE due to the country's high internet penetration rate and the increasing adoption of cloud technology. Cloud accounting software solutions offer several benefits, including scalability, automatic updates, and the ability to access data from anywhere.

ERP accounting software is an essential tool for businesses in the UAE looking to improve their financial management and streamline their operations. By selecting a solution that meets their specific needs and budget, businesses can gain a competitive advantage and position themselves for success in the long term.

ERP accounting software in UAE is the ability to generate real-time financial reports, which can provide insights into a company's financial performance at any given moment. This can help businesses make informed decisions about budgeting, investments, and expansion plans.

ERP accounting software in UAE can enhance collaboration between different departments and teams within an organization, allowing for more efficient communication and sharing of data. This can help reduce errors and improve productivity.

ERP accounting software in UAE also includes features that can automate and streamline the payment process, making it easier to pay vendors, suppliers, and employees. This can help improve cash flow management and reduce the risk of errors or fraud.

ERP accounting software in UAE solutions offer mobile apps, allowing business owners and managers to access financial information on-the-go. This can be particularly helpful for businesses with remote teams or multiple locations. The benefits of ERP accounting software in the UAE are many, including improved financial management, streamlined operations, enhanced collaboration, and the ability to make informed decisions based on real-time data. By investing in the right solution, businesses in the UAE can position themselves for long-term success in an increasingly competitive marketplace.

18 April, 2023

ERP accounting software in Oman refers to computer programs that are designed to help businesses manage their financial transactions and recordkeeping. These software programs are specifically designed to automate accounting tasks and make the process more efficient and accurate. The use of ERP accounting software is essential for businesses in Oman that are required to comply with the Value Added Tax (VAT) system implemented by the government.

One important type of vat accounting software that businesses in Oman need is VAT filing software. This software helps businesses to calculate and file their VAT returns to the tax authorities. It automates the process of collecting and recording data related to VAT transactions, and provides accurate reports and financial statements.

Another essential type of ERP accounting software is VAT accounting software. This software is designed to manage all aspects of VAT accounting software in Oman, including calculating and recording VAT transactions, generating VAT reports, and providing real-time visibility into a company's VAT position. This type of software helps businesses in Oman to comply with the tax regulations and avoid penalties for non-compliance.

For small businesses in Oman, a simple bookkeeping software can be a good option. This type of software is designed to provide basic accounting functionality such as recording transactions, generating financial statements, and managing accounts receivable and payable. It is a cost-effective solution for businesses that do not require advanced online accounting software features.

For larger businesses in Oman, an ERP accounting software can be a more comprehensive solution. ERP accounting software is an integrated software system that combines accounting functionality with other business operations such as inventory management, sales, and customer relationship management. It provides a centralized platform for managing all aspects of a company's financial operations, and helps to streamline business processes and improve efficiency.In summary,Vat accounting software is an essential tool for businesses in Oman to manage their financial transactions and comply with tax regulations. The specific type of ERP accounting software required depends on the size and complexity of the business, and the level of accounting functionality needed. Some important types of best accounting software in Oman include VAT filing software in Oman, VAT accounting software in Oman, simple bookkeeping software in Oman, and ERP accounting software in Oman.

ERP accounting software in Oman is a crucial component of modern businesses in Oman. It helps businesses to manage their financial operations more efficiently, automate tasks, and reduce errors. In addition to the types of best accounting software mentioned earlier, there are several other types of ERP accounting software in Oman that businesses may find useful.

Accounting software. This type of software is designed to manage employee payroll, including calculating wages and taxes, generating payslips, and maintaining records. It helps businesses to ensure compliance with labor laws and regulations, and reduces the risk of errors and penalties.

ERP accounting software is project accounting software. This software is designed to manage accounting tasks related to specific projects, such as tracking expenses, billing clients, and monitoring project profitability. It provides real-time visibility into project finances and helps businesses to make informed decisions about resource allocation and project management.

Inventory accounting software is another useful type of best accounting software in Oman. This software is designed to manage inventory levels, track inventory movements, and generate inventory reports. It helps businesses to optimize inventory management, reduce costs, and improve customer service.

Finally, financial reporting software is a type of ERP accounting software in Oman that businesses can use to generate financial statements and reports. This software automates the process of compiling financial data, and provides accurate and up-to-date reports that can be used to inform decision-making.

ERP accounting software is an essential tool for businesses in Oman to manage their financial operations and comply with tax regulations. There are several types of accounting software available, including VAT filing software, VAT accounting software, billing software, cloud accounting software, best accounting software, and financial reporting software. Choosing the right ERP accounting software depends on the specific needs and requirements of the business.

18 April, 2023

Best accounting software in Oman refers to a computer program that helps businesses and individuals manage their financial transactions, record keeping, and reporting. With the increasing demand for automation and accuracy in financial management, many businesses in Oman are now turning to cloud accounting software in Oman.

Cloud accounting software in Oman provides users with the ability to manage their financial transactions remotely, which can help businesses reduce their overhead costs. Additionally, cloud accounting software can provide real-time data, which allows for better decision-making and strategic planning.

Billing software in Oman is also an essential component of best accounting software in Oman, as it helps businesses manage their billing processes efficiently. The billing software in Oman can automate the invoicing process, track payments, and manage customer accounts, which can help businesses save time and reduce errors.

When searching for the best accounting software in Oman, it's essential to consider factors such as ease of use, functionality, and affordability. Some of the most popular billing accounting software in Oman include Proffinonline. These online accounting software programs offer features such as invoicing, expense tracking, financial reporting, and inventory management.

Best accounting software in Oman is a vital tool for businesses in Oman, as it helps them manage their financial transactions, record keeping, and reporting. With the increasing demand for automation and accuracy in financial management, cloud accounting software in Oman has become increasingly popular. When selecting ERP accounting software in Oman, businesses should consider factors such as ease of use, functionality, and affordability, as well as specific keywords such as cloud accounting software in Oman and billing software in Oman.

Benefits of ERP Accounting Software: ERP accounting software in Oman has many benefits for businesses, including improved accuracy and efficiency in financial management, reduced costs, and increased productivity. With the ability to automate repetitive tasks such as data entry and report generation, online accounting software allows businesses to focus on more strategic activities, such as growing their customer base and improving their products and services.

Types of Best Accounting Software: There are several types of best accounting software in Oman available, including on-premise, cloud accounting software, and hybrid solutions. On-premise ERP accounting software in Oman is installed on a local server and managed by the business, while cloud accounting software is hosted on remote servers and accessed through a web browser. Hybrid solutions combine both on-premise and cloud accounting software features.

Features of ERP Accounting Software: ERP accounting software in Oman typically includes a range of features, such as invoicing, payment processing, expense tracking, financial reporting, and inventory management. Some ERP accounting software also offers additional features such as project management, time tracking, and payroll management.

Choosing ERP Accounting Software: When choosing ERP accounting software in Oman, businesses should consider their specific needs and budget, as well as factors such as user-friendliness, customization options, and customer support. It's also essential to consider the security and reliability of the software provider, particularly when using cloud accounting software solutions.

Best Accounting Software in Oman: Oman has a growing market for ERP accounting software, with many businesses adopting cloud accounting software solutions to improve their financial management. With the country's increasing focus on digital transformation, billing software in Oman is becoming an essential tool for businesses of all sizes in Oman.

Integration with Other Systems: ERP accounting software can integrate with other systems, such as payment gateways, inventory management software, and CRM systems. This integration can help businesses streamline their workflows and reduce data entry errors.

Mobile Access: Many ERP accounting software providers offer mobile apps that allow users to access their financial data and perform tasks such as invoicing and expense tracking from their smartphones or tablets. This mobile access can be especially useful for businesses with employees who work remotely or travel frequently.

Training and Support: When implementing accounting software, it's essential to consider the training and support available from the software provider. Some providers offer online training resources, while others may provide on-site training or dedicated support staff to help businesses get up and running with the software.

Reporting and Analytics: ERP accounting software can provide businesses with real-time financial data and generate reports and analytics to help them make informed decisions about their operations. These reports can include information on cash flow, profitability, and expense trends.

Compliance and Taxation: ERP accounting software can help businesses stay compliant with tax regulations and reporting requirements. Many software providers offer features such as automated tax calculations and support for VAT and other tax codes.

In conclusion, best accounting software is an essential tool for businesses in Oman and around the world. It can help businesses improve their financial management, streamline their workflows, and make informed decisions about their operations. When selecting ERP accounting software, businesses should consider their specific needs, budget, and the features and support offered by the software provider.

18 April, 2023

Online accounting software in saudi Arabia refers to computer programs that enable organizations to manage their financial transactions and accounts. In Saudi Arabia, there are certain ERP accounting software that are approved billing software in Saudi Arabia and online accounting software purposes.

Approved billing software in Saudi Arabia refers to billing software that has been certified and authorized by the Saudi Arabian government. These ERP accounting software programs comply with the country's regulations, and they are recognized as suitable for billing purposes.

Approved accounting software in Saudi Arabia, on the other hand, refers to ERP accounting software in Saudi Arabia that has been authorized by the government for use in managing financial accounts. These software programs comply with the country's accounting standards and regulations. Examples of approved accounting software in Saudi Arabia include Proffinonline

ERP accounting software Saudi Arabia refers to Enterprise Resource Planning (ERP) software that is specifically designed for managing financial transactions and accounts. These online accounting software programs provide a comprehensive platform for managing accounting processes, such as bookkeeping, invoicing, and financial reporting. Examples of ERP accounting software in Saudi Arabia include Proffinonline

Online accounting software Saudi Arabia is a computer program that helps organizations manage their financial transactions and accounts. In Saudi Arabia, there are approved billing software and approved accounting software that comply with the country's regulations. ERP accounting software programs that provide a comprehensive platform for managing accounting processes.

Approved accounting software in Saudi Arabia is a vital tool for businesses of all sizes, as it helps them to efficiently manage their financial records and transactions. In addition to the approved billing software and approved accounting software in Saudi Arabia, there are various other types of online accounting software available in the market that offer a range of features and functionalities.

Cloud accounting software in Saudi Arabia solutions that allow businesses to access their financial data and records from anywhere, at any time. These software programs offer features such as automatic data backup, real-time financial reporting, and integration with other business applications.

There are also industry-specific online accounting software solutions that cater to the needs of specific industries, such as construction, healthcare, and hospitality. These software programs are designed to handle the unique financial requirements and regulations of these industries.

ERP accounting software in Saudi Arabia is open-source online accounting software, which allows users to access the source code and modify the ERP accounting software according to their needs. This type of software is often used by developers and tech-savvy businesses who want to customize their ERP accounting software to meet their specific requirements.

Online accounting software in Saudi Arabia is an essential tool for businesses of all sizes and types, and there are various types of software available in the market that cater to the specific needs and requirements of different businesses. In Saudi Arabia, there are approved billing software and approved accounting software that comply with the country's regulations and standards, and businesses can choose from a range of other software solutions that offer various features and functionalities to manage their financial records and transactions.

ERP accounting software in Saudi Arabia can help businesses in many ways. One of the primary benefits of using online accounting software is that it helps businesses to streamline their financial processes and make them more efficient. With accounting software, businesses can automate tasks such as invoicing, payroll processing, and financial reporting, which can save them time and reduce the risk of errors.

ERP accounting software can also provide businesses with real-time financial data and insights. With up-to-date financial information, businesses can make more informed decisions and quickly respond to changes in the market. Additionally, online accounting software in Saudi Arabia can help businesses to identify areas where they can reduce costs or increase revenue, which can help them to become more profitable.

Another benefit of ERP accounting software is that it can help businesses to stay compliant with financial regulations and standards. In Saudi Arabia, the use of approved billing software in Saudi Arabia and approved accounting software in Saudi Arabia can help businesses to ensure that they are complying with the country's regulations. ERP accounting software can also provide businesses with tools to manage their taxes, including calculating and filing taxes accurately and on time.In conclusion, online accounting software can help businesses to streamline their financial processes, provide real-time financial data and insights, identify cost-saving opportunities, and ensure compliance with financial regulations and standards. In Saudi Arabia, the use of approved billing software and approved accounting software can help businesses to ensure that they are complying with the country's regulations, while other types of online accounting software can provide businesses with various features and functionalities to manage their financial records and transactions.

17 April, 2023

ERP accounting software Saudi Arabia is a computer program that is designed to assist businesses with recording, processing, and managing their financial transactions. These online accounting software programs can perform a variety of tasks such as managing accounts receivable and payable, payroll, inventory, budgeting, and generating financial reports.

The above contents refer to e-invoicing approved software in Saudi Arabia. E-invoicing software, or electronic invoicing, is the process of creating, sending, and receiving invoices electronically. In Saudi Arabia, there are specific software programs that have been approved by the government for e-invoicing purposes. These e-invoicing approved software in Saudi Arabia programs must comply with the regulations set forth by the Saudi Arabian Monetary Authority (SAMA) and be able to generate valid electronic invoices that can be submitted to the General Authority of Zakat and Tax (GAZT).

Therefore, if a business in Saudi Arabia wishes to engage in e-invoicing approved software, they must use one of the approved software programs that have been certified by SAMA. Failure to use an e-invoicing approved software in Saudi Arabia program can result in penalties and fines from the government.

E-invoicing approved software has become increasingly popular in recent years, as it offers a number of benefits over traditional paper-based invoicing. These benefits include increased efficiency, reduced costs, improved accuracy, and enhanced security. By using e-invoicing, businesses can streamline their invoicing processes, reduce errors, and improve their cash flow management.

In Saudi Arabia, the government has implemented e-invoicing approved software as part of its efforts to modernize the tax system and improve compliance. All businesses that are registered for value-added tax (VAT) in Saudi Arabia are required to issue electronic invoices, and these invoices must comply with certain technical and legal requirements.

To ensure compliance with these requirements, the Saudi Arabian Monetary Authority (SAMA) has established a certification process for e-invoicing approved software providers. Only software programs that have been certified by SAMA are considered approved software for e-invoicing approved software in Saudi Arabia. E-invoicing approved software is a modern and efficient way for businesses to manage their invoicing processes. In Saudi Arabia, businesses must use e-invoicing approved software programs for e-invoicing, as mandated by the government. By using approved software, businesses can ensure compliance with regulations and enjoy the benefits of e-invoicing.

The approved software for e-invoicing in Saudi Arabia must comply with the technical and legal requirements set forth by the government. These requirements include the use of specific data elements, formatting standards, and security protocols. The software must be able to generate valid electronic signatures and provide audit trails for each transaction.

Using approved software for e-invoicing can help businesses avoid penalties and fines from the government. If a business is found to be using non-compliant software or is issuing incorrect or fraudulent invoices, it can face severe consequences, including fines, suspension of its VAT registration, and even legal action.

E-invoicing approved software in Saudi Arabia, there are many other types of online accounting software Saudi Arabia available for businesses in Saudi Arabia. Some software programs are designed for specific industries or types of businesses, while others are more general and can be used by a wide range of businesses.

When choosing an online accounting software Saudi Arabia program, businesses should consider their specific needs and requirements. Factors to consider may include the size of the business, the number of transactions it processes, the level of automation desired, and the features and functionality needed.

Online accounting software Saudi Arabia is an essential tool for businesses in Saudi Arabia and around the world. For e-invoicing specifically, approved software programs are mandatory in Saudi Arabia and must comply with the government's technical and legal requirements. Choosing the right online accounting software Saudi Arabia can help businesses improve their financial management and achieve their business objectives.

17 April, 2023

ERP (Enterprise Resource Planning) accounting software Saudi Arabia refers to a suite of integrated applications that help organizations manage their financial and online accounting software processes. This type of online accounting software in Saudi Arabia can provide features such as accounts payable, accounts receivable, general ledger, payroll, and financial reporting.

Saudi Arabia, there is a particular emphasis on cloud accounting software and ZATCA (Zakat, Tax and Customs Authority) approved software. Cloud accounting software Saudi Arabia refers to applications that are hosted in the cloud, allowing users to access them from anywhere with an internet connection. This type of online accounting software Saudi Arabia is becoming increasingly popular in Saudi Arabia, as it allows businesses to manage their finances more efficiently and effectively.

ZATCA approved software Saudi Arabia is also essential for businesses operating in Saudi Arabia, as it ensures compliance with the country's tax regulations. ZATCA approved software in Saudi Arabia is responsible for collecting Zakat (an Islamic tax) and taxes in Saudi Arabia, and it requires businesses to use ZATCA approved software to ensure accurate reporting.

Businesses in Saudi Arabia may also be looking for simple accounting software solutions, which can provide the necessary functionality without being overly complex or difficult to use.

ERP accounting software that meets the requirements of cloud-based accounting software Saudi Arabia, ZATCA-approved software, and simple functionality can be an excellent solution for businesses in Saudi Arabia looking to manage their finances efficiently and effectively while complying with the country's tax regulations.

ERP accounting software Saudi Arabia is a comprehensive system that allows organizations to manage all of their financial operations in one place, from accounts payable and receivable to payroll and financial reporting. The online accounting software in Saudi Arabia is designed to streamline financial processes, increase efficiency, and provide better visibility into financial data.

In ERP accounting software Saudi Arabia, cloud accounting software Saudi Arabia is becoming increasingly popular due to its flexibility and scalability. With cloud-based software, businesses can access their financial data from anywhere with an internet connection, allowing for better collaboration and decision-making. Additionally, cloud-based accounting software Saudi Arabia can help businesses reduce their IT costs, as it eliminates the need for on-premises infrastructure and maintenance.

ZATCA-approved software Saudi Arabia is essential for businesses operating in Saudi Arabia, as it ensures compliance with the country's tax regulations. The software must meet specific requirements set by ZATCA approved software to ensure accurate reporting and avoid penalties. By using ZATCA-approved software, businesses can ensure they are meeting their tax obligations and avoiding potential legal issues.

Simple accounting software solutions are also essential for businesses in Saudi Arabia. Not all businesses require the same level of functionality, and some may prefer a more straightforward system that is easy to use and understand. Simple accounting software solutions Saudi Arabia can provide the necessary functionality while still being user-friendly and accessible.

ERP accounting software that meets the requirements of cloud-based accounting software, ZATCA-approved software, and simple functionality can help businesses in Saudi Arabia manage their finances more efficiently and effectively while complying with the country's tax regulations. It's important for businesses to carefully evaluate their options and choose a software solution that meets their specific needs and requirements.

ERP accounting software Saudi Arabia offers many benefits to businesses in Saudi Arabia. One of the main advantages is increased efficiency. The software automates many financial processes, such as invoice processing, payment processing, and financial reporting, reducing the amount of time and effort required to complete these tasks manually. This can save businesses a significant amount of time and money, allowing them to focus on other aspects of their operations.

ERP accounting software is better visibility into financial data. The software provides real-time access to financial data, allowing businesses to make informed decisions based on accurate and up-to-date information. This can help businesses identify trends and patterns in their financial data, make better financial decisions, and avoid potential financial risks.

Cloud-based ERP accounting software is particularly advantageous in Saudi Arabia due to the country's rapidly evolving business landscape. As the economy continues to grow and change, businesses need software solutions that are flexible and scalable to meet their changing needs. Cloud accounting software Saudi Arabia provides this flexibility and scalability, allowing businesses to easily adapt to changes in the market and their operations.

ZATCA-approved software is essential for businesses in Saudi Arabia to comply with the country's tax regulations. By using ZATCA-approved software Saudi Arabia, businesses can ensure they are accurately reporting their financial data, avoiding penalties, and maintaining their reputation.

ERP accounting software that meets the requirements of cloud accounting software, ZATCA-approved, and simple accounting software functionality can provide many benefits to businesses in Saudi Arabia. From increased efficiency to better visibility into financial data, ERP accounting software can help businesses improve their financial processes and make more informed decisions.