When it comes to the best accounting software in Oman, businesses have various options that offer robust features and functionalities. Online accounting software in Oman is designed to streamline financial management processes and help businesses maintain accurate and organized financial records. Here is an explanation of the key features and benefits typically associated with the best accounting software in Oman:

Financial Management: The best accounting software in Oman provides comprehensive financial management tools, including general ledger, accounts payable and receivable, bank reconciliation, and budgeting. These features help businesses track and manage their income, expenses, and cash flow efficiently.

Invoicing and Billing: The ERP accounting software in Oman offers invoicing and billing functionalities to generate professional invoices, track sales, and manage receivables. It allows businesses to customize invoice templates, automate recurring invoices, and track payment status to ensure timely collection.

Expense Tracking: Online accounting software in Oman helps businesses track and categorize expenses accurately. It provides features for recording and categorizing expenses, allowing businesses to monitor spending patterns, identify cost-saving opportunities, and prepare for tax reporting.

Financial Reporting and Analysis: The online accounting software in Oman generates a variety of financial reports, such as income statements, balance sheets, and cash flow statements. These reports provide insights into the financial health of the business and assist in making informed decisions. Additionally, the software may offer analysis tools to assess profitability, monitor key performance indicators (KPIs), and identify trends.

VAT Compliance: As Oman has implemented a value-added tax (VAT) system, the best accounting software in Oman includes features to calculate and manage VAT. It automates VAT calculations, generates VAT reports, and ensures compliance with the local VAT regulations.

Multi-Currency Support: Oman's business environment often involves transactions in multiple currencies. The ERP accounting software in Oman provides multi-currency support, allowing businesses to handle transactions and financial reporting in different currencies accurately.

Bank Integration: The online accounting software in Oman integrates with banks, enabling seamless bank reconciliation and automated import of bank transactions. This feature minimizes manual data entry and reduces errors in reconciling financial records.

Data Security: The best accounting software in Oman prioritizes data security. It incorporates encryption and secure data storage measures to protect sensitive financial information from unauthorized access.

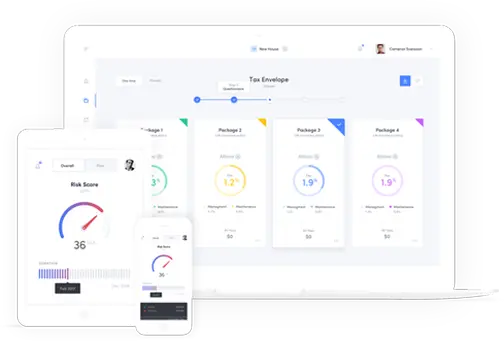

User-Friendly Interface: Online accounting software in Oman is designed with a user-friendly interface, making it easy to navigate and use even for those without extensive accounting knowledge. It typically includes intuitive menus, dashboard views, and step-by-step guides to streamline the accounting process.

Scalability and Customization: The ERP accounting software in Oman offers scalability to accommodate businesses of different sizes and growth stages. It should be flexible enough to handle increasing transaction volumes and adapt to changing business needs. Customization options allow businesses to tailor the software to their specific requirements and branding.

Support and Updates: The best accounting software in Oman typically comes with reliable customer support and regular software updates. This ensures ongoing assistance for users, resolves any issues that may arise, and keeps the software up to date with the latest regulatory changes and enhancements.

The best accounting software in Oman provides robust financial management tools, invoicing and billing capabilities, expense tracking, financial reporting and analysis, VAT compliance, multi-currency support, bank integration, data security, a user-friendly interface, scalability, customization options, and reliable support. It helps businesses in Oman streamline their accounting processes, maintain accurate financial records, ensure compliance with regulations, and make informed financial decisions.