Online accounting software refers to computer programs or applications designed to assist businesses in managing their financial processes and transactions. It provides tools and features to automate tasks related to simple bookkeeping software, financial reporting, invoicing software, and compliance with regulatory requirements.

When online accounting software is described as "ZATCA approved software," it means that it has received approval or recognition from the Zanzibar Revenue Board (ZATCA) or a similar regulatory body. This indicates that the ERP accounting software meets the specific standards and requirements set by the regulatory authority for financial record-keeping, reporting, and tax compliance purposes.

Similarly, "e-invoicing approved software" refers to online accounting software that has been certified or authorized for electronic invoicing processes. E-invoicing software is the electronic exchange of invoice documents between suppliers and buyers. Approved software in this context ensures compliance with legal and technical standards for creating, transmitting, and storing electronic invoices.

In general, "approved software" refers to online accounting software that has undergone a certification process or meets specific criteria established by regulatory bodies or industry authorities. These certifications or approvals indicate that the online accounting software is compliant, reliable, and suitable for fulfilling legal and financial requirements.

Online accounting software, regardless of specific approvals, offers several key functionalities and benefits:

-

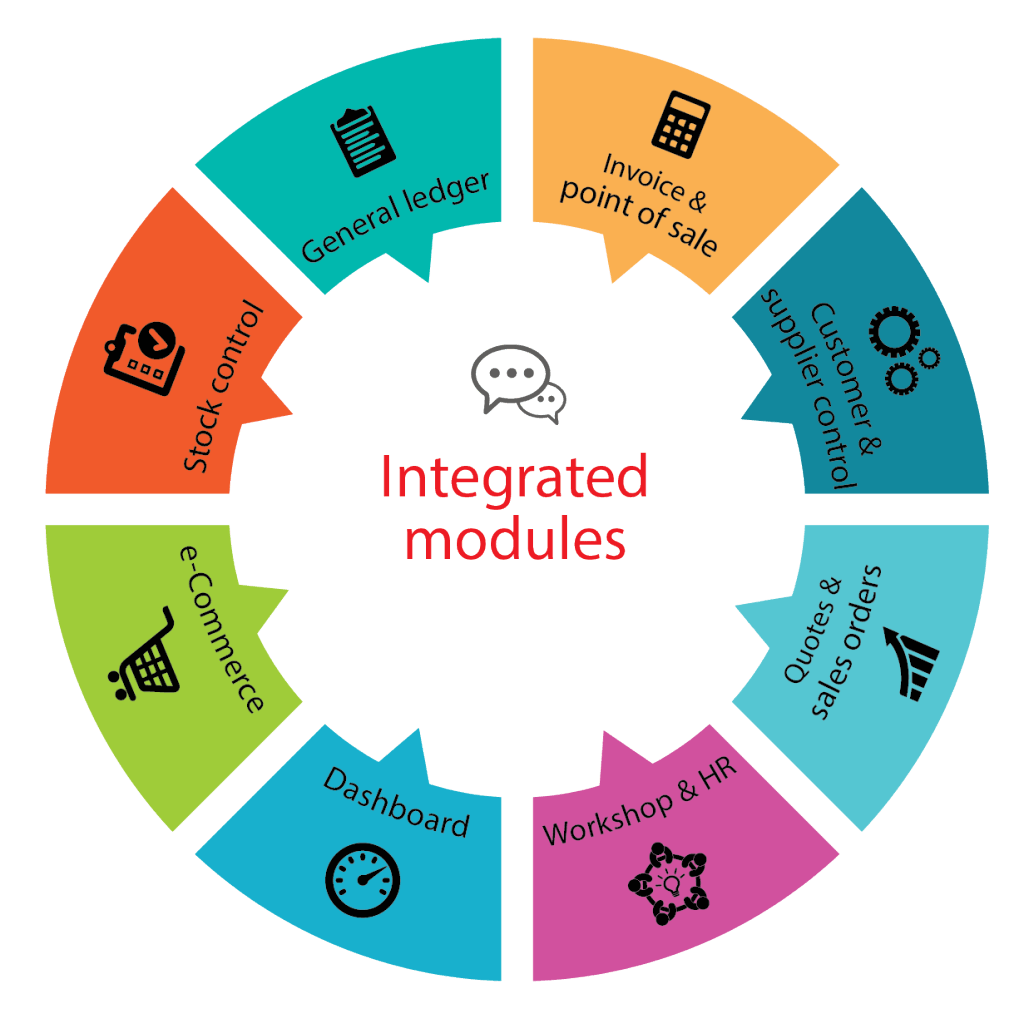

Financial Recording and Transactions: Online accounting software allows businesses to record financial transactions accurately and efficiently. It captures and organizes data related to sales, purchases, expenses, and payments, ensuring a clear audit trail and reliable financial records.

-

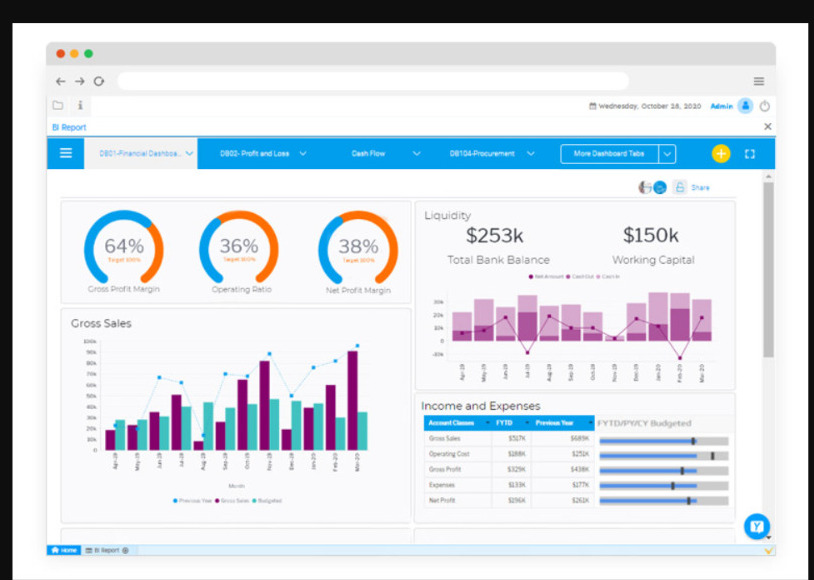

Financial Reporting and Analysis: Online ccounting software generates various financial reports, such as balance sheets, income statements, cash flow statements, and general ledgers. These reports provide insights into the financial health of the business, helping stakeholders make informed decisions and evaluate performance.

-

Invoicing and Billing: Online accounting software streamlines the invoicing software process, enabling businesses to create and send professional invoices to customers. It tracks payments, manages overdue invoices, and generates reports to monitor cash flow and outstanding receivables.

-

Expense Management: Online accounting software simplifies expense tracking and management. It allows businesses to categorize and track expenses, reconcile bank statements, and generate expense reports for better cost control and budgeting.

-

Tax Management: Online accounting software automates tax calculations, generates tax forms, and helps businesses comply with tax regulations. It ensures accurate calculation of taxes, tracks tax liabilities, and assists in preparing tax returns.

-

Integration and Collaboration: Online accounting software solutions offer integration capabilities with other business systems, such as CRM, inventory management, or payroll software. This integration enables seamless data flow, eliminates manual data entry, and enhances collaboration across different departments.

-

Data Security and Backup: Online accounting software includes security features to protect financial data, such as user access controls and data encryption. Regular backups and secure storage options ensure data integrity and protection against data loss or unauthorized access.

Online accounting software is a valuable tool for businesses to streamline financial processes, maintain accurate records, generate insightful reports, and comply with regulatory requirements. Whether it is ZATCA approved software, e-invoicing approved software, or meets other industry-specific approvals, online accounting software plays a crucial role in efficient financial management and decision-making.

-

Inventory Management: Online accounting software often includes inventory management features that enable businesses to track and manage their inventory levels. It helps monitor stock movements, track product costs, and streamline procurement processes. This functionality ensures efficient inventory control, reduces stockouts, and optimizes order fulfillment.

-

Budgeting and Forecasting: ERP accounting software assists in budgeting and forecasting by allowing businesses to set financial goals, allocate budgets to different expense categories, and compare actual results with planned budgets. It provides insights into spending patterns, helps identify areas of improvement, and supports financial planning for future growth.

-

Multi-Currency Support: Online accounting software solutions offer multi-currency support, allowing businesses to conduct transactions and manage finances in different currencies. This functionality is especially valuable for businesses engaged in international trade or operating in multiple countries.

-

Audit Trail and Compliance: ERP accounting software maintains an audit trail by recording and tracking all financial transactions. It provides a comprehensive history of changes made to financial records, ensuring transparency and facilitating compliance with auditing and regulatory requirements.

-

Client and Vendor Management: Online accounting software often includes features to manage client and vendor information. It helps track customer invoices, payments, and outstanding balances. For vendors, businesses can record purchase orders, track payments, and manage vendor relationships more efficiently.

-

Customization and Scalability: Online accounting software offers customization options to tailor the software to the specific needs of a business. It allows businesses to configure chart of accounts, add custom fields, or create personalized reports. Online accounting software is designed to scale with businesses as they grow, accommodating increased transaction volumes and expanding requirements.