In today's fast-paced business world, efficient financial management is the cornerstone of success. Whether you run a small startup or a well established enterprise in the UAE, staying on top of your finances is essential. Billing software in the UAE has become a game changer for businesses of all sizes, offering a powerful solution to simplify billing and invoicing processes, streamline operations, and enhance overall efficiency. In this blog, we will explore the benefits of billing software in UAE and how it can transform the way you manage your finances.

Time Saving Automation

Managing invoices and billing manually can be a time consuming task, prone to errors and inefficiencies. Billing software in UAE automates this process, saving you time and reducing the risk of human error. With just a few clicks, you can generate invoices, send them to clients, and even set up recurring invoices for regular payments. The software can also track the status of invoices, reminding you of any outstanding payments. This automation ensures that you never miss a bill and that your cash flow remains healthy.

Customization and Professionalism

Billing software in UAE allows you to create professional invoices that reflect your brand's identity. You can customize templates to include your logo, company details, and payment terms. This level of professionalism not only impresses your clients but also fosters trust. The software also allows for different currency and language options, making it a convenient choice for international businesses operating in the UAE.

Enhanced Accuracy

Billing software in UAE significantly reduces the risk of errors in your financial transactions. It calculates taxes, discounts, and totals automatically, eliminating the need for manual calculations. This enhanced accuracy ensures that your invoices are always correct, preventing disputes and saving you valuable time that you can redirect toward more strategic business activities.

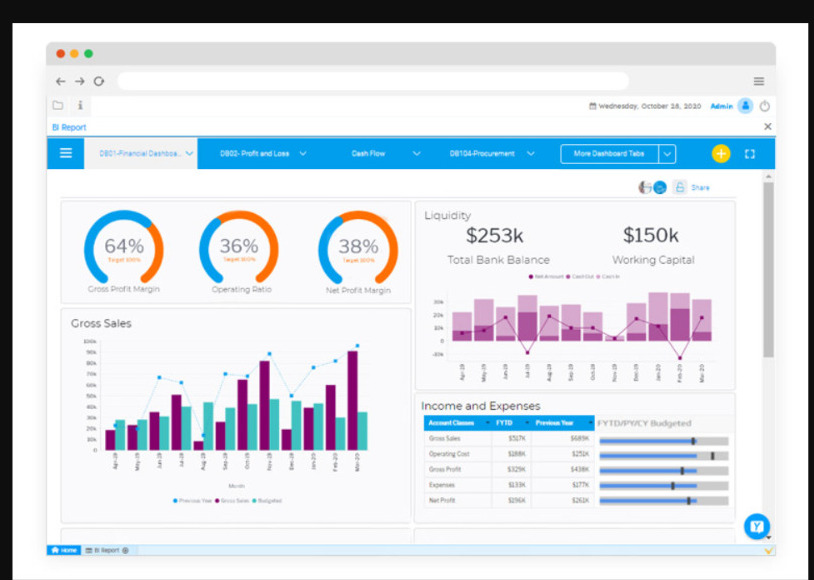

Real-Time Financial Insights

Another advantage of billing software in UAE is the ability to gain real-time financial insights. You can track revenue, monitor expenses, and analyze cash flow trends through intuitive dashboards and reports. This visibility allows you to make informed financial decisions promptly, keeping your business agile and adaptable in a dynamic market.

Efficient Payment Processing

Billing software in UAE often comes equipped with multiple payment options. Clients can pay invoices online, through credit card payments, or various other electronic payment gateways. This convenience speeds up the payment process, reducing the time it takes to get paid and improving your cash flow.

Compliance and Security

Staying compliant with UAE's financial regulations is crucial for any business. Billing software in UAE can help by automatically generating invoices that adhere to the required legal standards. Additionally, it ensures the security of your financial data, reducing the risk of data breaches and unauthorized access.

Conclusion

Billing software in UAE is a powerful tool for businesses looking to streamline their financial processes and enhance their overall efficiency. Its time-saving automation, customization options, accuracy, real time insights, efficient payment processing, and compliance features make it an invaluable asset for any business operating in the UAE. By adopting billing software, you can focus on growing your business while the software takes care of your financial management needs.

.jpg)