Billing software in Saudi Arabia refers to a type of software designed to handle the invoicing and billing processes of businesses. In the context of Saudi Arabia, billing software in Saudi Arabia specifically refers to software tailored to meet the invoicing and billing needs of businesses operating in the Saudi Arabian market.

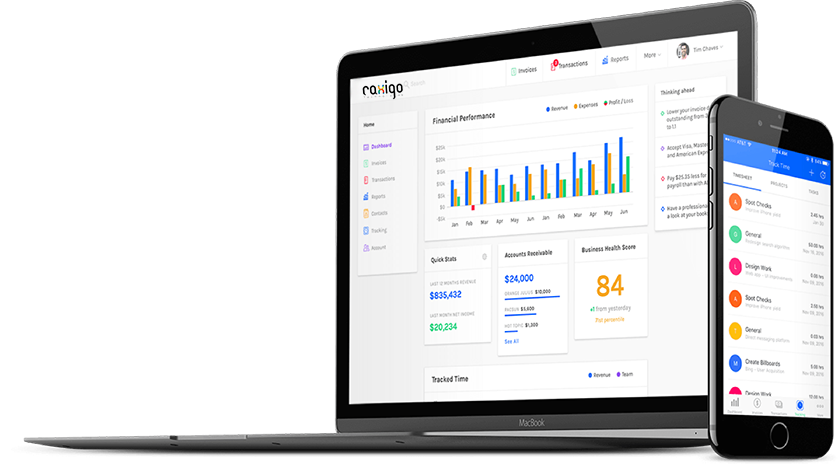

Online accounting software in Saudi Arabia, on the other hand, is a broader term that encompasses a range of functionalities beyond billing. ERP accounting software Saudi Arabia helps businesses manage their financial transactions, recordkeeping, reporting, and other accounting tasks. While billing software focuses primarily on the invoicing and billing aspects,online accounting software Saudi Arabia provides a more comprehensive solution for financial management.

Online accounting software typically includes features such as:

-

Invoicing and Billing: Online accounting software allows businesses to generate and customize invoices for their products or services. It tracks payments, creates payment reminders, and manages accounts receivable.

-

Expense Tracking: Businesses can record and track their expenses, categorize them, and generate expense reports. This feature helps in monitoring and managing expenses, improving budgeting, and identifying cost-saving opportunities.

-

Financial Reporting: Online accounting software generates financial reports such as profit and loss statements, balance sheets, cash flow statements, and tax reports. These reports provide insights into the financial health of the business and aid in decision-making.

-

Bank Reconciliation: The ERP accounting software can reconcile bank statements with recorded transactions, ensuring accuracy and identifying any discrepancies or errors.

-

Inventory Management: Online accounting software includes inventory management features, allowing businesses to track their stock levels, monitor sales, and manage purchase orders.

-

Payroll Management: Advanced ERP accounting software may include payroll functionalities to handle employee compensation, tax deductions, and generate payslips.

-

Tax Compliance: Online accounting software helps with tax calculations, tracks tax obligations, and generates necessary tax forms, ensuring compliance with local tax regulations.

In the context of Saudi Arabia, Online accounting software with billing software capabilities would be designed to meet the specific invoicing requirements, tax regulations, and accounting practices of the Saudi Arabian market. It would support the Saudi Arabian Riyal currency, provide VAT (Value Added Tax) calculations, and comply with local accounting standards.

Online accounting software with billing software capabilities in Saudi Arabia offers businesses an efficient and streamlined solution for managing their financial transactions, invoicing processes, and complying with local accounting and tax requirements.